Back Market has carved a niche in the burgeoning market for refurbished electronics, particularly smartphones. Since its inception, the French startup has transformed from a relatively unknown entity into a significant player, drawing considerable investor attention and managing to sell millions of gadgets. While the startup experienced significant growth during the pandemic, the recent economic downturn has prompted it to recalibrate its strategies to maintain its momentum and ensure sustainability.

The past few years have been a rollercoaster ride for Back Market, one that has seen highs and lows similar to many within the tech industry. In the buoyant economic climate of 2021, fueled by universally low-interest rates, Back Market successfully raised an impressive $335 million during its Series D funding and followed that with an additional $510 million in Series E funding within months. This meteoric rise led to a staggering valuation of $5.7 billion. However, as the global economy began to decelerate, Back Market was compelled to adapt, resulting in workforce layoffs late last year. The leadership justified these measures as necessary steps toward achieving profitability amid shifting market conditions.

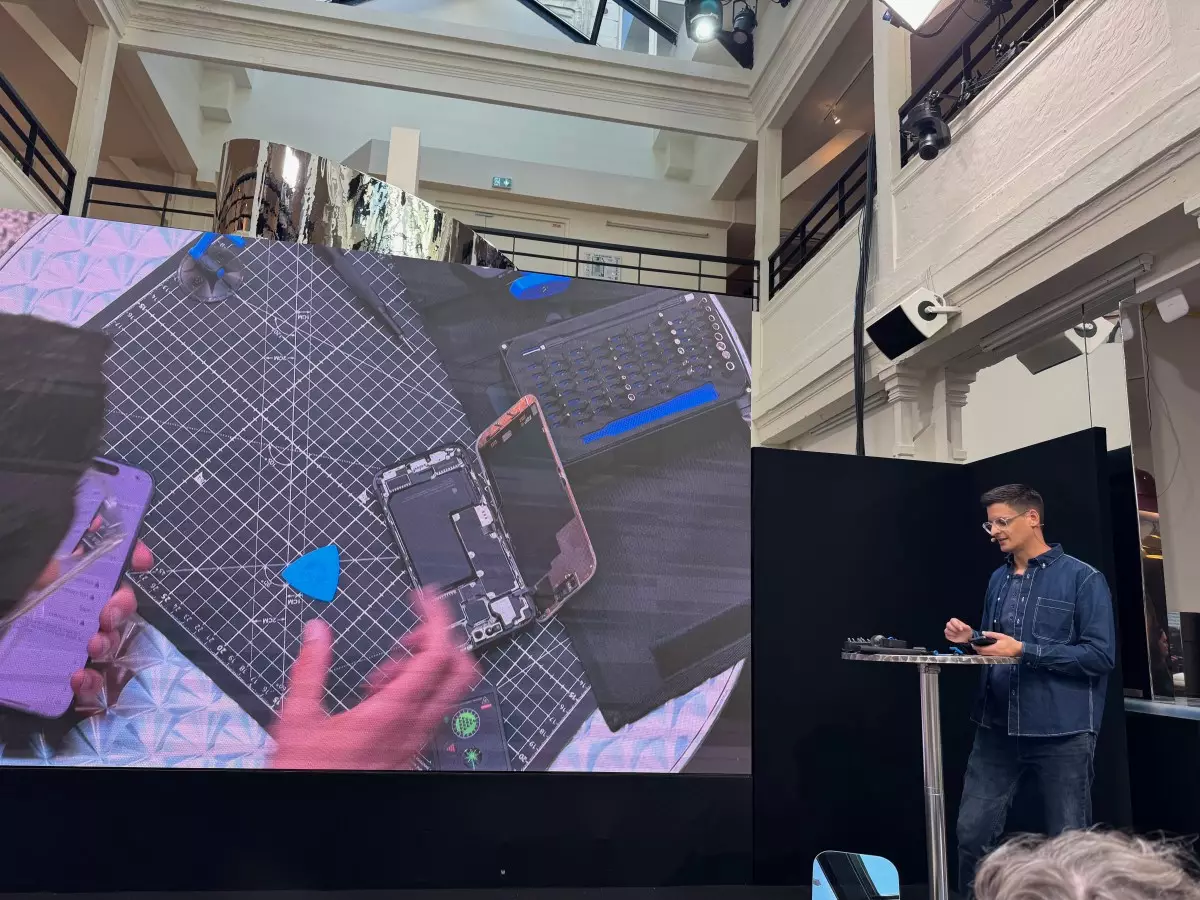

During their recent press conference in Paris, Back Market outlined plans for the future, emphasizing a dedication to product launches and innovative projects. The startup aims to enhance its market presence and broaden its premium offerings, encouraging more consumers to consider purchasing refurbished devices. The realization that newer smartphone models often present only minor advancements has reinforced the appeal of refurbished devices. By marketing these devices’ cost-effectiveness and their reduced environmental impact, Back Market has positioned itself attractively to eco-conscious consumers.

A notable aspect of Back Market’s strategy involves partnering with various companies rather than directly managing inventory. Collaborating primarily with 1,800 partner companies that repair and resell gadgets is central to its business model. This collaboration approach has led to the sale of over 30 million refurbished devices to a customer base exceeding 15 million users. However, recognizing inventory limitations has spurred Back Market to forge new partnerships to bolster supply. A highlighted relationship with Sony for PlayStation consoles exemplifies this approach, wherein existing customers can trade in their devices for discounts on new purchases. Such strategic collaborations are seen as essential for boosting Back Market’s offerings, extending its reach where customers want to shop.

Consumer concerns surrounding the quality of refurbished products remain paramount. Back Market has taken steps to address these worries by providing options across various condition grades, from “fair” to “excellent.” More recently, the introduction of a “premium” tier enhances customer confidence, as these devices come exclusively with official parts, ensuring a higher quality assurance. This dedication to quality is further underscored by an aggressive tracking system aimed at reducing faulty devices in their inventory. The current defective rate stands at a mere 4%, representing a significant quality standard in the refurbished market.

Alongside improving device quality, Back Market is leveraging technology to enrich the customer experience. Updates to their app will soon allow users to manage their devices more effectively and even gamify their experience through rewards and badges. Furthermore, features like an easy method for users to evaluate their current gadgets are set to launch around significant shopping events like Black Friday. These technological inclusions not only streamline customer navigation but also enhance engagement.

When considering its growth strategy, Back Market seeks inspiration beyond the realm of electronics. Co-founder Thibaud Hug de Larauze has openly expressed admiration for the widespread adoption of second-hand car purchases, noting that the automotive industry has established a robust framework for reliability and spare parts accessibility. With the European Union moving toward regulations that will mandate companies to provide spare parts, similar to the car industry, Back Market is poised to benefit significantly from these shifts in consumer behavior and regulatory frameworks.

As Back Market gears itself toward a profitable 2024, the company is undergoing a significant transformation, shedding its previous image as merely an “impact company.” This redesign is not just about financials but also about cultivating a perception of reliability and commitment to sustainability. Achieving profitability will not only solidify Back Market’s foothold in Europe but also serve as a launching pad for expansion into international markets, particularly the United States.

In navigating the complexities of the refurbished electronics landscape, Back Market demonstrates resilience and an innovative spirit. Their concerted efforts to expand partnerships, enhance product quality and integrate technology signify a promising trajectory. As they position themselves as a leader in sustainable tech, Back Market may not just redefine consumer habits toward electronics but potentially reshape an entire industry. Awaiting further developments, it will be interesting to observe how they harness their current strategies to sustain growth in the coming years.