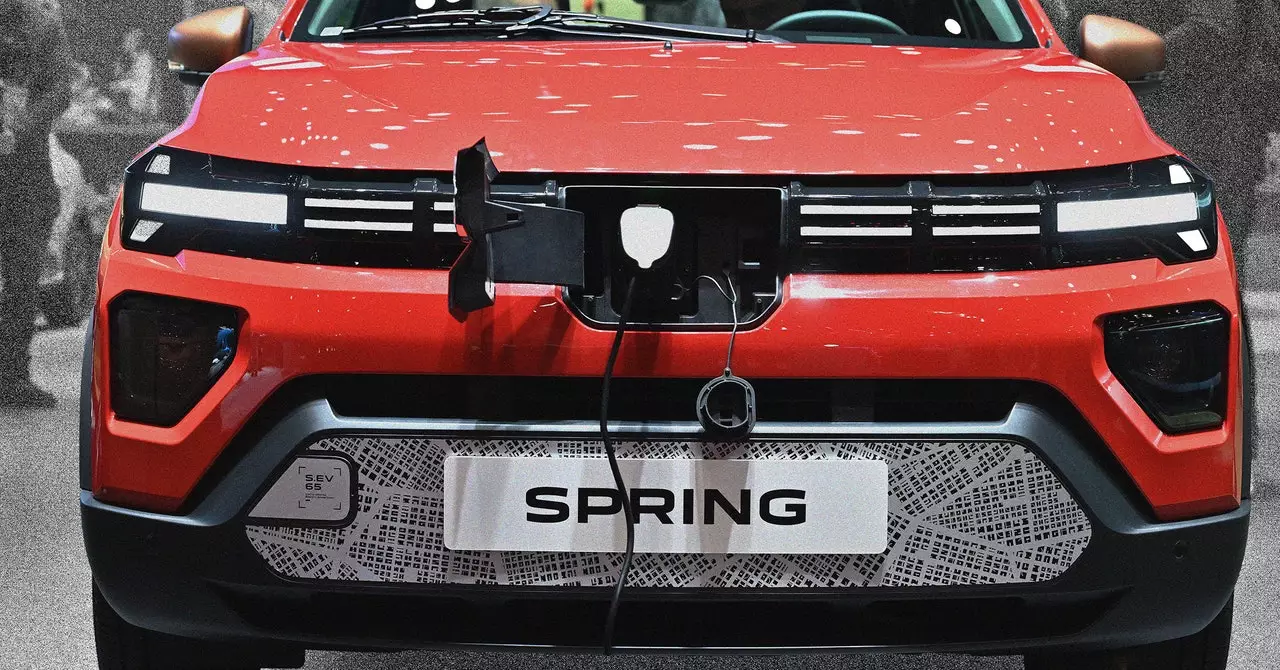

The global automotive industry is witnessing a seismic shift as electric vehicle (EV) manufacturers, particularly from China, increasingly compete for dominance in international markets. Recent tariff developments in Europe present a complex landscape for both Chinese and European automotive brands, influencing their strategies, pricing, and production decisions. This article delves into how these dynamics are unfolding for key players, particularly BYD, Tesla, and various European manufacturers, and assesses the broader implications for the industry.

Ilaria Mazzocco, a senior fellow at the Center for Strategic and International Studies, articulates a promising scenario for BYD, one of China’s leading EV manufacturers. The company’s ability to maintain low production costs allows it to offer competitively priced vehicles, especially amidst increasing tariffs aimed primarily at Chinese automakers. While BYD stands to benefit from reduced competition from its Chinese counterparts, the tariffs pose significant challenges for brands struggling to maintain profitability without inflating prices to match competition from established European labels.

In contrast, Tesla, which produces a substantial portion of its vehicles in China at its Shanghai Gigafactory, faces a relatively minor tariff adjustment of 7.8%. The company has successfully negotiated terms based on its specific subsidies, providing it a considerable advantage over its European counterparts that may bear tariffs of up to 21%. Tesla’s positioning allows it to leverage both its production efficiencies in China and its established brand reputation in Europe.

To mitigate the impact of tariffs, a strategic shift may see some Chinese manufacturers establishing production facilities within Europe itself, echoing the steps taken by Volvo under Geely’s ownership. This localization strategy not only circumvents tariffs but also contributes to local economies, potentially strengthening public sentiment towards Chinese brands. A pivotal concern raised by experts, including Mazzocco, is the credibility of announcements regarding new factories; the actual realization of these plans is crucial for assessing their true impact on employment and economic growth in Europe.

Despite recent tariff approvals, negotiations between the European Commission and China remain on the table. There exists a possibility that tariffs could be renegotiated or adjusted if both parties manage to agree on alternative frameworks, such as import quotas or price floors. This developing narrative underscores the complexity of global trade dynamics and the constant shifts in negotiations, particularly within the context of unfair competition allegations.

The European Commission’s decision to impose tariffs highlights its intent to showcase unity against a rising influx of Chinese EVs. Yet the potential for future negotiations also offers some room for maneuvering in the landscape of international trade. Economists now ponder various scenarios: while an import quota might seriously disadvantage Chinese exports and disrupt their market strategies, a manageable price floor could incentivize higher profit margins and spur competition based on quality and service rather than pricing alone.

Mazzocco notes that many Chinese manufacturers are confident in the quality of their products, suggesting that even obligatory price increases may not deter consumer interest if products meet or exceed expectations. This confidence points to a significant trend where luxury offerings, such as BYD’s Yangwang brand that caters to high-end markets with innovative features, become increasingly relevant amid the evolving competitive landscape.

The landscape of the automotive industry, particularly regarding electric vehicles, is evolving dramatically in response to tariff implementations and market dynamics. This report highlights how companies like BYD can seize competitive advantages while others navigate the intricate challenges posed by evolving trade policies. Ultimately, as the EU and China continue to negotiate, the outcome will not only influence manufacturers but also shape the future of the EV market, with consequences for consumers and economies alike. The interplay of cooperation and competition will determine which brands flourish in a rapidly shifting automotive world, emphasizing the need for strategic foresight and adaptability among global players.